According to a 2023 Eurofound report, more than 30% of employees in the EU have worked from home at least occasionally, and cross-border remote work is growing as companies embrace global hiring. Remote work has opened up a world of opportunities for employees and employers alike. Today, many professionals are exploring ways to work from anywhere, including for companies based in Belgium. Whether you’re a Belgian employee hoping to live abroad or an international professional considering work for a Belgian company remotely, you likely have questions about compliance, payroll, and the practicalities of remote work.

Below, we address 8 of the biggest queries around working remotely for a Belgian company and show how Employer of Record (EOR) services like those offered by INS Global can make the process simpler, safer, and more streamlined.

Can I Work for a Belgian Company Remotely from Overseas?

The short answer is yes, but there are important legal, tax, and compliance considerations to keep in mind for both employees and employers.

Legal and Tax Implications of Working Abroad

When an employee works from another country, they often become subject to the local labor and tax laws of that country. For Belgian employees moving abroad, this can mean changes to where income tax and social security contributions must be paid. Belgium has double taxation treaties with more than 80 countries, but these treaties can be complex and require careful planning to avoid double taxation.

For example, if you move to France but remain employed by a Belgian company, you may become a French tax resident after 183 days. This could mean paying income tax in France, even if your salary is processed in Belgium. Employers need to plan for these obligations, as failing to do so can lead to fines or backdated payments.

How Belgian Employment Law Affects Remote Workers

Belgium’s employment law applies to most employment contracts governed by Belgian law, regardless of where the work is physically performed. This means employees working abroad while on Belgian contracts are typically still entitled to their Belgian contractual rights, such as paid vacation (at least 20 days per year), termination protections, and salary payment standards.

However, employees may also be entitled to additional rights under local law in their host country. For instance, in some EU states, local minimum wage rules or public holiday entitlements may be higher than Belgium’s, and employers must adjust accordingly.

Employer Responsibilities for Cross-Border Employees

Employers must ensure proper payroll and social security contributions are made. If an employee moves abroad, it may require registering with the foreign country’s social security authorities or utilizing EU coordination rules. According to the Belgian social security office, failing to register an employee abroad can result in fines ranging from €200 to €2,000 per infraction.

For employers, tracking and maintaining compliance with multiple jurisdictions can quickly become administratively complex, which is where outside support, particularly offering local expertise, becomes a particularly attractive solution.

How do Employer of Record Services Work?

An Employer of Record (EOR) is a third-party provider that legally employs a worker on behalf of a company, handling payroll, compliance, and HR administration. This model has become increasingly popular: the global EOR market is projected to grow steadily at more than 6% CAGR between 2023 and 2028, reflecting how businesses are using this approach to access talent worldwide.

EOR vs. Traditional Employment: Key Differences

With traditional employment, a company must have a legal entity in the country where the employee resides. The process of setting up and then managing administration for this entity can be expensive and time-consuming, requiring corporate registration, local accounting, and annual reporting, among other things.

An EOR, however, can act as the local employer for remote employees, meaning the company can have workers in multiple countries without setting up entities. This lets businesses start operations in a matter of days instead of months.

Payroll, Taxes, and Benefits Under an EOR

An EOR processes salaries in compliance with local regulations, withholds the correct taxes, and ensures social security contributions are paid. They can also administer benefits such as healthcare, retirement contributions, and paid leave in line with local labor requirements.

This payroll management ensures employees enjoy full protection and that employers avoid penalties. For instance, late or incorrect payroll filings in Belgium can incur fines of up to 10% of the unpaid contributions.

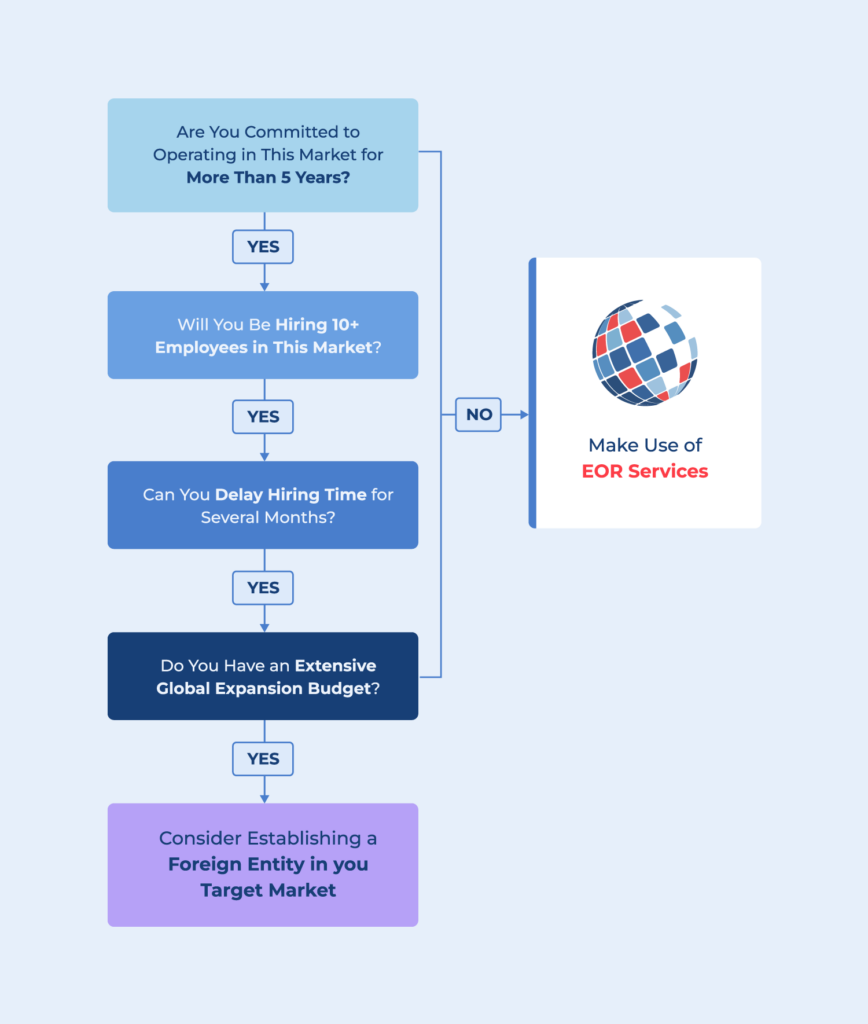

When to Use an EOR Instead of Setting Up an Entity

EOR services are ideal for:

- Companies testing a new market before committing to establishing a subsidiary.

- Employers with just one or two employees in a new country.

- Businesses that want to avoid the cost and risk of setting up a legal entity but still offer compliant and protective employment opportunity.

In addition, an EOR can support short-term projects, seasonal hires, or specialized roles where setting up an entity would be disproportionate.

Can I Work Remotely for a Company Through an EOR?

Yes. For many companies, an EOR is the simplest way to employ remote workers in another country. Employees sign an employment contract with the EOR but still perform work and report directly to the client company.

This ensures that employment is fully legal and that both the employer and employee are protected.

How Much Does an EOR Cost?

Typical Pricing Models for EOR Providers

Most EOR providers charge either a flat monthly fee per employee or a percentage of the employee’s gross salary. Flat fees are typically charged per employee per month, and depend on the country and level of service required.

Today there are many EOR providers, each with their own pricing structure and range of extra fees, though expertise and quality of service varies. To get the best pricing available it’s essential to pay close attention to potential hidden fees or unnecessary charges added by service providers without the right knowledge of a client’s needs or local requirements.

Cost Comparison: EOR vs. Setting Up a Subsidiary

Setting up a foreign subsidiary can cost thousands in legal fees and months of administrative work. In Belgium, incorporating a private limited company (SRL/BV) can take several weeks and involves notary fees, minimum share capital, and ongoing accounting costs.

EOR solutions bypass this process entirely, allowing employers to onboard remote staff almost immediately.

EOR Hidden Costs to Watch Out For

Employers should check for additional fees, such as charges for onboarding, offboarding, or changes to employment contracts.

At the same time, EOR providers without the right local expertise may add on charges unnecessarily due to not truly understanding local payroll needs.

Transparent pricing is essential when comparing EOR providers, as small hidden costs can add up quickly over time.

Are There Limitations When Working Overseas for a Belgian Company?

Social Security and Double Taxation Treaties

Belgium is part of the EU, which means that EU social security coordination rules apply.

In most cases, workers can stay within the Belgian social security system for up to 24 months when temporarily working abroad, but this requires obtaining an A1 certificate. Beyond that, employees may need to contribute to the host country’s system.

Double taxation treaties between Belgium and other countries help ensure employees don’t pay tax twice on the same income. However, employees must often still file tax returns in both countries to claim relief.

Time-Zone, Communication, and Productivity Challenges

Remote work across borders brings practical considerations such as problems with time-zone management, language barriers, and ensuring team cohesion. In fact, a recent Gallup survey showed that employees working across time zones report 15% lower engagement if communication tools and schedules are not well managed.

Employers should invest in collaboration platforms, set clear expectations for synchronous meetings, and maintain regular check-ins to support distributed teams.

What are the Risks of Choosing to Work for a Belgian Company Remotely?

Risk of Misclassification as an Independent Contractor

Some companies attempt to classify remote workers as independent contractors to avoid complexity. However, Belgian authorities are severe when it comes to penalties around such misclassification and may reclassify the worker as an employee if they meet the criteria for an employment relationship.

This can result in back taxes, penalties, and liability for unpaid benefits. Each year, the Belgian social inspection services conduct thousands of audits, resulting in millions in recovered social contributions for misclassified workers.

Corporate Tax Liability for the Employer (Permanent Establishment)

If an employee performs core business functions from another country, tax authorities may determine that the employer has a permanent establishment there. This can lead to corporate tax obligations in that country and potential fines for non-compliance.

Employee Rights and Protections Overseas

Employees may gain additional rights under the labor law of their host country, including minimum wage adjustments, working hour limits, and termination protections. Employers must ensure compliance with both Belgian and host-country law to avoid disputes or legal claims.

Conclusion – How INS Global’s Employer of Record Can Help Companies Work Worldwide

INS Global offers EOR solutions that allow Belgian companies to legally employ workers anywhere in the world, or support employees who wish to relocate internationally while maintaining employment. By handling payroll, compliance, and HR administration, INS Global reduces the risks of cross-border employment while keeping employees engaged and productive.

For employers, this means avoiding the costs of setting up entities and reducing compliance headaches. For employees, it ensures full access to benefits, legal protections, and timely salary payments. With over 160 countries supported, INS Global is a trusted partner for companies looking to scale globally without taking on unnecessary risk.

FAQ

A Specific Example – Can I Work for a Belgian Company in Spain?

Yes, but you must consider Spanish tax residency and social security rules. Using an EOR in Spain ensures you remain compliant with Spanish labor and tax law while still working for your Belgian employer.

A Specific Example – Can I Live in Belgium and Work for a US Company?

Yes. A US company can use an EOR in Belgium to employ you locally, so you remain compliant with Belgian payroll and tax obligations. This helps the US company avoid the cost of setting up a Belgian entity.

Can I Work Remotely in the EU for a Belgian Employer?

Generally, yes, but ensure that social security and tax compliance are handled correctly. An A1 certificate can help maintain Belgian social security contributions for temporary work abroad.

Can I Be Paid in Belgium While Living Abroad?

Yes, but the employer must ensure tax and payroll compliance in both Belgium and your country of residence. Employees should check whether their host country considers them tax residents and whether additional declarations are required.

What If I Want to Switch from Contractor to Employee?

An EOR can facilitate this transition by providing a compliant employment contract and payroll setup, protecting both you and your employer. This can also help access benefits like paid vacation, sick leave, and pension contributions.

SHARE